How to Have a No Spend Month in 2024 + Free Printable

2024 is quickly approaching. Setting new financial goals is always an important start to the new year. Whether you’re just beginning your debt free journey, you’ve been paying off debt for awhile, or you’re debt free, it’s always a good time to sit down and evaluate for the new year. One way that can get you on track quickly is a no spend month.

What is a no spend month?

A no spend month is a challenge where for one month, you will try to avoid spending money on unnecessary costs. No, you can’t stop paying your bills. But you will need to evaluate your monthly costs to separate necessary spending from your wants and nice-to-haves.

What are the rules for a no spend month?

The rules are pretty simple. If it isn’t an essential, you don’t spend money on it. I’ve seen people tip toe around the rules, but that will only set you up for failure. Remember your reasoning for doing the challenge in the first place.

How can I spend a month with no money?

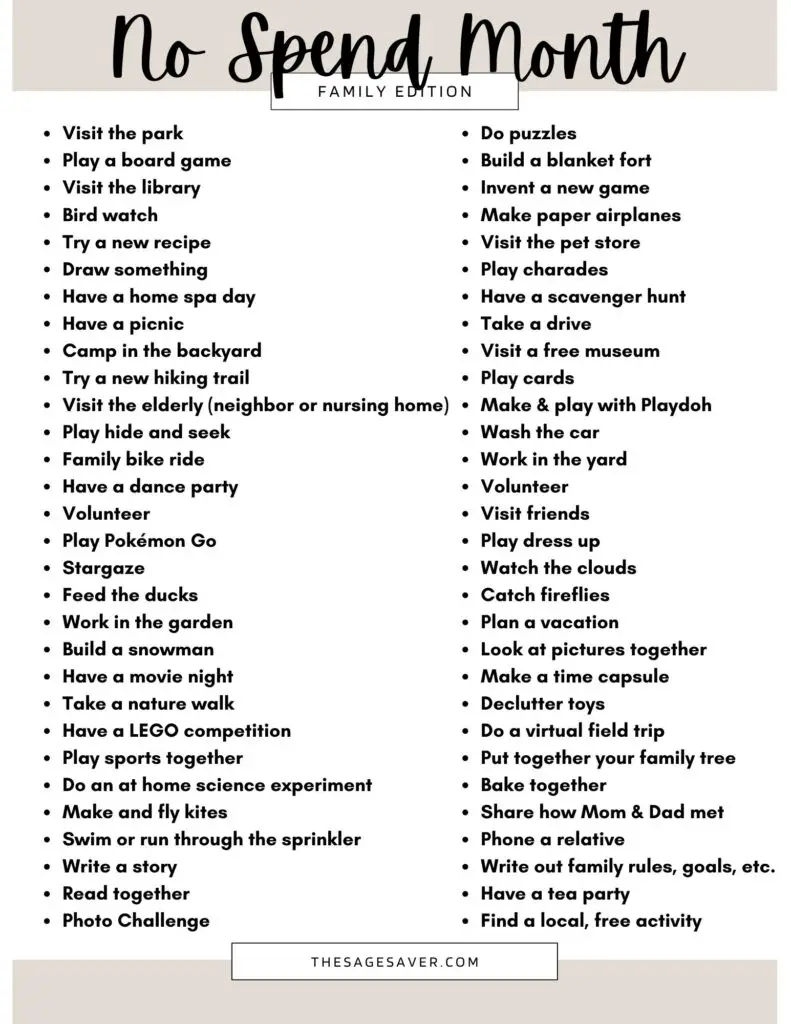

Try to find free things to do or keep yourself busy. Keep reading for our free printable list of no spend month ideas!

What about groceries?

You have to eat, so that’s an essential. Do you need take out? No. Do you need to buy a ton of junk food? Also, no.

How to be Successful in a No-Spend Month, 10 Tips and Tricks

Choose the right month

- Personally, I don’t typically do my no spend month in January like a lot of people do. We have two birthdays in January and we sometimes take a trip during that time. Maybe for you, that is a different month. Definietly avoid months with major holidays, as that will just make it more difficult for you to be successful.

Set your goals

- Remember why you’re doing this. Are you saving for something big or important to you? Are you ready to get out of debt for once and for all? Make sure you have clear goals for why you’re doing this. What will you do with the money you save?

Be on the same page

- If you’re married or have a family, be sure to make sure everyone is on the same page. Your spouse and you should be united on your goals and ready to keep one another accountable. Your children should be involved, so they know, this is temporary, but you all need to work together as a family.

Keep a visual

- A no spend month is a challenge after all. Keep it fun! We love using a visual chart for everyone to see up on the fridge. Just a simple checkmark or X is all you need. Did you meet your goal? Want to keep it up and go for another week, month, even year?

Remove temptation

- If you struggle to not buy things on amazon at random, delete amazon from your phone this month. If you can’t “window shop”, don’t go. If friends want to hang out, but you always spend money when you’re with them, invite them over for a game night instead. Remove anything that will make things harder on you.

Plan different activities

- Luckily for you, I have included a free list of some no spend month activities. However; you should have a few ideas off the top of what you can do. Plan some major home projects (that you already have supplies for), find some free things to do in your area, etc. If you have nothing to do, you may end up finding something that costs money.

Plan your meals

- Now is as good of a time as ever to start focusing on the next area you want to work on financially. Since you will be home, I’d recommend breaking that take out habit and focus on meal planning and cooking at home. It doesn’t have to be hard. If you own a crock pot or instant pot, it’s super easy to throw things in and have an at home dinner every night. We have several recipes if you need help!

Share with others

- You don’t need to share with everyone on your social media (unless you want to), but letting those closest to you know, may be helpful! Your friends and family can help keep you accountable. Maybe they have something you could borrow to keep from spending. Maybe they need help getting their spending under control too.

Be kind to yourself

- You’re probably not going to have a perfect month. Life happens. If you end up messing up or something comes up, X out your day on your chart and start over the next day. Do the best you can!

Celebrate

- Have a reward set in place for when you’re all done, but keep it simple. Maybe have a no spend month leading up to your vacation. Or let the kids pick out a carton of ice cream at the end of the month if they did a good job. Basically, don’t pick something so extravagant your whole month was a waste.

What do I do after the month is up?

Once you have finished your no spend month and you have celebrated your victory, consider going over your non essential spending. You just spent a month without it, now see what you truly need. Maybe you struggle with getting take out coffee or pricey makeup. Maybe you buy your kids new clothes or toys they don’t need. Find something you struggle over spending on and consider cutting spending on that for another month. Let’s break these habits and get out of debt once and for all! Most people have a spending problem, not an income problem.

Oh, I love this challenge. I definitely would like to try doing this for January. Yep, it seems to be the only month I can commit to since every month is someone’s birthday—big family.

Thanks for the template, too. I’m going to give it a try.

Birthdays and holidays can certainly make it tough! I’d love to hear how it went!